Is Manufacturing Down in the US? Real Data on Trends, Jobs, and Government Help

When people say manufacturing is dying in the US, they’re not wrong-but they’re not telling the whole story either. Factories aren’t vanishing. They’re changing. The number of manufacturing jobs has dropped since the 1950s, sure. But today’s US factories are making more stuff than ever-with fewer people. And the government is pouring billions into making sure that trend keeps going.

Manufacturing output is at an all-time high

Look at the numbers from the Federal Reserve. In October 2025, US manufacturing output hit 127.4 index points (2017 = 100). That’s higher than it’s ever been. Even after the pandemic supply chain mess, production didn’t just bounce back-it broke records. Factories are making more cars, more semiconductors, more wind turbines, and more medical devices than they did in 2019.

Why? Automation. Robots don’t take breaks. They don’t unionize. And they don’t need health insurance. A single automated assembly line today can do the work of 20 workers from 20 years ago. That’s why employment numbers look bad even when output is soaring.

Jobs are down, but not because factories closed

The US lost about 5 million manufacturing jobs between 1998 and 2010. That’s the number everyone quotes. But here’s what they leave out: most of those jobs didn’t disappear because factories shut down. They disappeared because machines got smarter. A Ford plant in Louisville that once employed 2,500 workers now runs with 800-and produces 40% more vehicles.

And it’s not just cars. In electronics, a single semiconductor fab in Arizona can produce more chips than 50 factories in China did a decade ago. The US isn’t losing manufacturing-it’s upgrading it. The jobs that remain pay more, too. The average manufacturing wage in 2025 is $32.50 an hour, nearly 20% higher than the national average.

Government programs are bringing manufacturing back

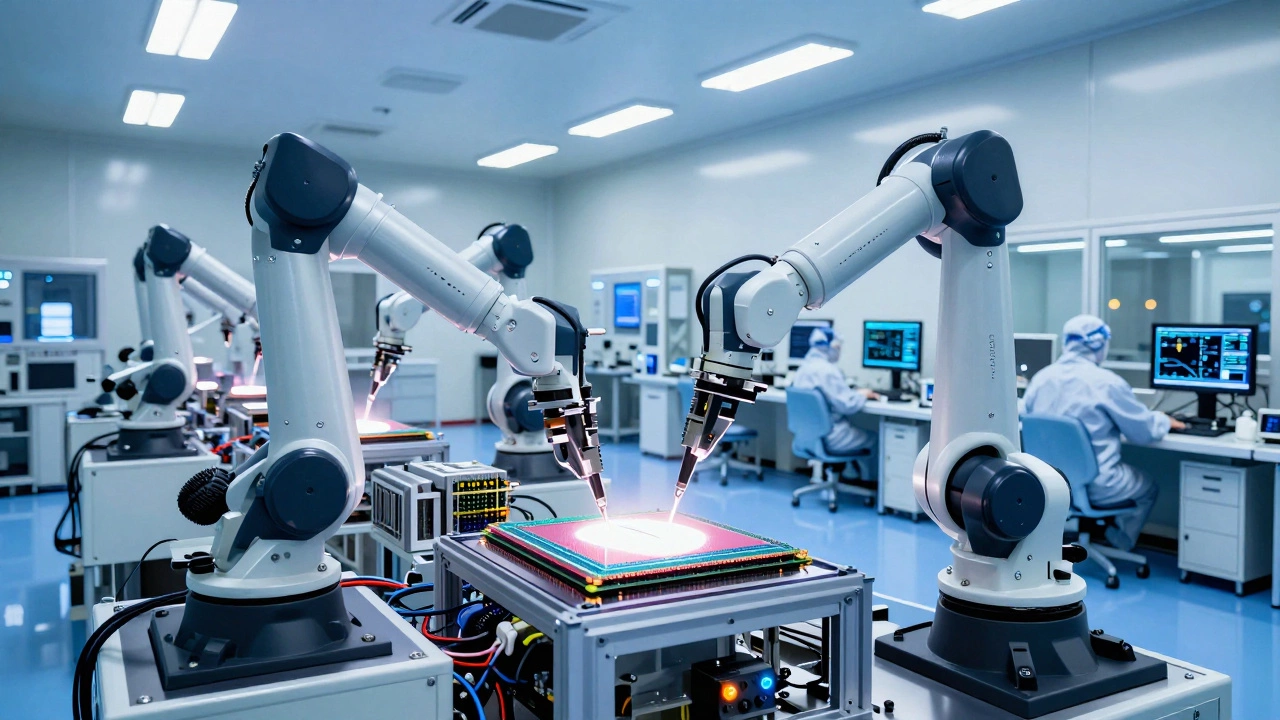

The CHIPS and Science Act of 2022 isn’t just a bill-it’s a national reset. The US government pledged $52 billion to build semiconductor factories. So far, companies like Intel, TSMC, and Samsung have committed over $200 billion in private investment to build 30+ new chip plants across Ohio, Arizona, Texas, and New York. These aren’t old-school assembly lines. These are billion-dollar clean rooms with robotic arms moving wafers in sterile environments.

The Inflation Reduction Act (IRA) added another layer. It gives tax credits to companies that make clean energy gear in the US. Solar panels? $1.25 per watt if made domestically. Wind turbines? Up to $20 million per project. Batteries? Up to $45 per kWh. That’s why Tesla’s Gigafactory in Nevada is expanding, and why a new lithium-ion plant just broke ground in Georgia with $1.8 billion in federal support.

And it’s not just tech. The Department of Commerce launched the Manufacturing USA network-17 regional innovation hubs focused on advanced materials, biomanufacturing, and robotics. These aren’t just labs. They’re training centers where workers learn to run AI-powered CNC machines and 3D printers. Over 40,000 people have been trained since 2022.

Where manufacturing is growing-and where it’s not

Some sectors are booming. Others are shrinking. Here’s what’s actually happening:

- Growing: Semiconductors, batteries, medical devices, aerospace, renewable energy equipment

- Stable: Food processing, pharmaceuticals, industrial machinery

- Declining: Textiles, basic plastics, low-value electronics assembly

Why the difference? It’s about value. Companies aren’t moving production back to the US to make cheap T-shirts. They’re coming back to make high-margin, high-tech stuff that needs skilled workers and strict quality control. A single medical implant made in Indiana can sell for $5,000. A plastic toy made in Vietnam sells for $3. The math is obvious.

What’s really driving the shift?

It’s not just government money. It’s a mix of three things:

- Supply chain risk: After COVID, companies realized they can’t rely on one country for critical parts. Making chips or insulin in the US reduces risk.

- Energy costs: US natural gas prices are 60% lower than Europe’s. That makes energy-intensive industries like aluminum and fertilizer cheaper to produce here.

- Consumer preference: A 2024 survey by Deloitte found 62% of Americans are willing to pay more for products made in the US-especially if they’re tech-heavy or environmentally friendly.

That last point matters. It’s not just policy. It’s culture. People want American-made EVs, American-made solar panels, American-made batteries. And companies are listening.

What’s still broken?

Don’t get it twisted. There are still huge problems. The US still imports 80% of its rare earth minerals. We still don’t have enough skilled workers to fill 800,000 open manufacturing jobs. Training programs are growing, but they’re not keeping up. And many small factories still can’t afford the $5 million robot arms that big companies use.

Also, not every region benefits equally. Ohio and Texas are getting factories. Rural West Virginia? Not so much. The government’s focus is on tech-heavy industries. That leaves behind places that once made furniture, textiles, or basic metal parts.

What’s next?

The next wave of manufacturing won’t be about big factories with smokestacks. It’ll be about distributed, digital, and decarbonized production. Think 3D printing small batches of custom parts in local hubs. Think AI predicting machine failures before they happen. Think factories powered by rooftop solar and battery storage.

The US isn’t losing manufacturing. It’s reinventing it. And the government isn’t just helping-it’s betting billions that this reinvention will work. Whether it succeeds depends on two things: training enough workers to run these new machines, and making sure the benefits reach more than just the coasts.

Is manufacturing down in the US?

No. It’s just different. Output is up. Wages are up. Investment is up. The jobs look different, but they’re still there-and they’re better paid. The old factories may be gone, but the new ones are smarter, cleaner, and more valuable than ever.

Is manufacturing really declining in the US?

No, manufacturing output is at a record high. While the number of workers has dropped due to automation, factories are producing more goods than ever before. The US made more semiconductors, batteries, and medical devices in 2025 than in any previous year.

Why are manufacturing jobs disappearing if output is rising?

Automation and robotics have replaced manual labor. A single automated production line today can do the work of 15-20 workers from the 1990s. This means fewer people are needed to make more products. The jobs that remain require technical skills and pay higher wages.

What government programs are helping US manufacturing?

The CHIPS and Science Act provides $52 billion for semiconductor production, with over $200 billion in private investment already committed. The Inflation Reduction Act offers tax credits for making solar panels, batteries, and wind turbines in the US. Manufacturing USA hubs train workers in advanced tech, and the Department of Commerce supports regional innovation centers.

Are American-made products really better?

They’re not always cheaper, but they’re often higher quality and more reliable. A 2024 Deloitte survey found 62% of US consumers are willing to pay more for products made domestically-especially tech, medical devices, and clean energy equipment. Supply chain reliability and environmental standards also drive this preference.

What industries are growing in US manufacturing?

Semiconductors, lithium-ion batteries, medical devices, aerospace components, and renewable energy equipment are growing fastest. These industries require advanced technology, skilled labor, and strict quality control-areas where the US has a competitive edge.

Why aren’t more small factories benefiting from these programs?

Most government incentives target large-scale, capital-intensive projects like chip fabs or battery plants. Small manufacturers often lack the resources to navigate complex grant applications or afford upfront tech investments. Some regional programs are starting to help, but support for small businesses still lags behind.