Government Manufacturing Incentives in India: What You Actually Get

When you hear government manufacturing incentives, cash grants, tax breaks, and infrastructure support offered by Indian states to encourage factory setup and production. Also known as industrial subsidies, these are not just slogans—they’re real tools used by thousands of small and mid-sized factories across India to lower startup costs and scale production. This isn’t about big corporations getting handouts. It’s about local entrepreneurs in places like Ludhiana, Tiruppur, and Hyderabad getting access to money they can actually use—to buy machines, hire workers, or upgrade their power supply.

These incentives aren’t one-size-fits-all. Each state runs its own program. Tamil Nadu gives land at discounted rates for electronics makers. Uttar Pradesh offers up to 100% stamp duty waiver for new factories. Gujarat has special zones with 24/7 power and fast-track clearances. And under the central government’s Production Linked Incentive (PLI) scheme, a national program that pays manufacturers based on how much they produce and export, not how much they invest, companies making phones, solar panels, and pharmaceuticals have received billions in direct payouts. You don’t need to be a giant like Apple or Reliance to qualify. Many small suppliers who make parts for bigger brands are getting paid too.

What most people don’t realize is that these incentives often come with strings—but they’re not the ones you think. It’s not about paperwork overload. It’s about proving you’re actually making something, not just importing and repackaging. The government checks production records, payroll data, and export documents. If you’re making 5,000 units a month and claiming a subsidy for 10,000, you’ll get caught. But if you’re honest, consistent, and growing? The support can be life-changing. One factory owner in Coimbatore used a PLI grant to buy three new CNC machines. Two years later, he’s exporting to Germany.

There are also state-level schemes for recycling, energy efficiency, and automation. If you switch to solar power, you might get a 30% subsidy on your setup cost. If you upgrade your waste system to meet environmental norms, some states will cover half the bill. These aren’t hidden programs—they’re listed on state industrial departments’ websites, but most small owners don’t know where to look. That’s why so many miss out.

Below, you’ll find real stories from Indian manufacturers who’ve used these incentives to survive, grow, or even start from nothing. Some got grants to build their first factory. Others used tax breaks to hire their first ten workers. You’ll see what worked, what didn’t, and what the government actually requires—not what they say they want.

Is Manufacturing Down in the US? Real Data on Trends, Jobs, and Government Help

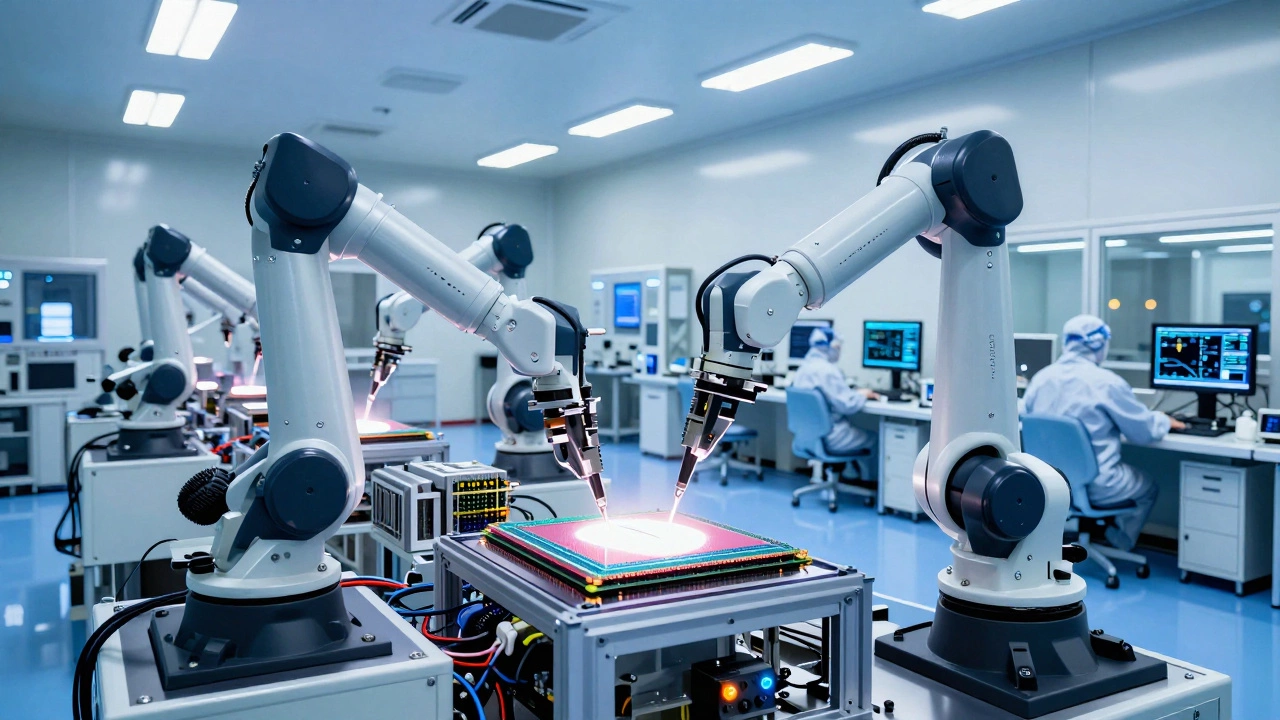

US manufacturing output is at record highs despite fewer workers. Government programs like the CHIPS Act and Inflation Reduction Act are driving a tech-driven revival in semiconductors, batteries, and clean energy production.

Read More