Who is the largest supplier of textiles in the world?

When you pull on a cotton t-shirt or tuck yourself into a soft bedsheet, chances are it came from a factory thousands of miles away. The global textile industry is massive - worth over $1.5 trillion in 2025 - and dominated by just a few countries. But who actually holds the top spot as the largest supplier of textiles in the world? The answer isn’t as simple as it sounds, because "supplier" can mean different things: total production, export volume, or raw material output. And when you dig into the numbers, one country stands far ahead of the rest.

China is the undisputed leader in textile production

China produces more textiles than any other country on Earth. In 2025, it accounted for nearly 40% of global textile output, according to the International Textile Manufacturers Federation. That’s more than the next five countries combined. China doesn’t just make fabric - it grows cotton, spins yarn, weaves cloth, dyes patterns, and sews finished garments all under one roof. Its supply chain is so deep and efficient that even brands based in the U.S. or Europe rely on Chinese factories for 60-80% of their basic apparel.

Why does China dominate? It’s not luck. The country invested heavily in textile infrastructure over the last 30 years. It built over 12,000 textile mills, developed advanced automation in weaving and cutting, and created special economic zones where factories get tax breaks and fast-track permits. Cities like Guangzhou, Hangzhou, and Shaoxing are now global hubs for fabric sourcing. You can walk into a market in Shaoxing and buy 10,000 meters of polyester fabric in a single day - something no other country can match at that scale.

India is the second-largest producer - and the biggest exporter of cotton textiles

If China is the factory, India is the farm and the artisan. India is the world’s largest producer of cotton, growing nearly 25% of the world’s supply. It also has the highest number of handloom weavers - over 4 million - who create intricate handwoven fabrics like Banarasi silk, Chanderi, and Kanchipuram. But here’s the twist: while India produces less total textile than China, it leads the world in cotton textile exports.

In 2025, India exported $42 billion worth of cotton fabrics, garments, and home textiles - more than any other country. Bangladesh, Vietnam, and Turkey are close behind, but none match India’s mix of volume, variety, and quality. Indian mills produce everything from basic plain-weave cotton to high-end jacquard bed linens. And because India’s labor costs remain low, many global retailers - from H&M to Target - source their basic cotton tees and towels from Indian factories.

What sets India apart is its ability to handle small orders. A U.S. boutique might order 500 units of a unique linen shirt. China typically requires minimum orders of 5,000. India can do 500 - and do it well. That’s why niche fashion brands, eco-conscious labels, and ethical fashion startups increasingly turn to India.

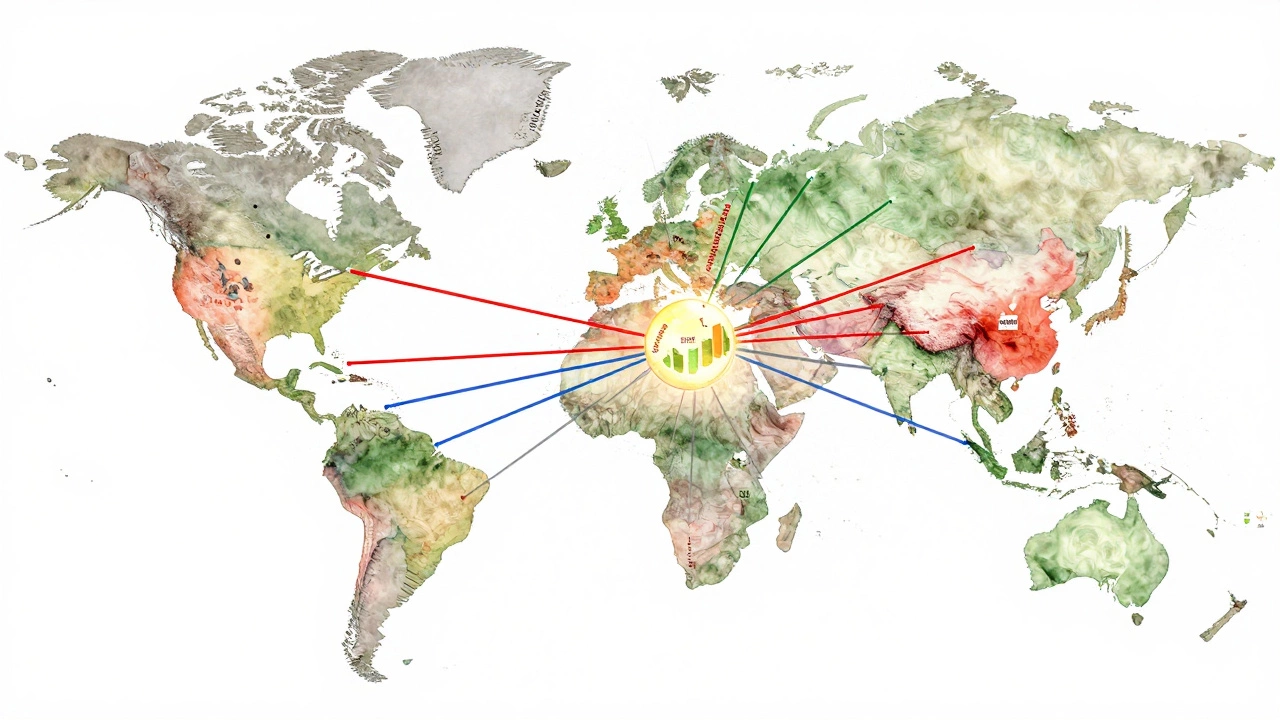

The role of other major players

While China and India lead, other countries hold key niches. Vietnam has become a major hub for apparel manufacturing, especially after trade tensions pushed brands to diversify. In 2025, Vietnam exported $38 billion in textiles - mostly ready-made garments. Bangladesh, despite political instability, remains the second-largest garment exporter after China, shipping over $36 billion in clothing annually, mostly to the U.S. and EU.

Turkey is the top supplier of home textiles to Europe - think towels, curtains, and bed sets. It’s known for high-quality cotton and fast turnaround times. Pakistan, meanwhile, is a major player in yarn and denim fabric. Its textile exports hit $16 billion in 2025, with a strong focus on raw materials rather than finished goods.

Even the U.S. and Germany aren’t out of the game. The U.S. leads in technical textiles - think medical gowns, bulletproof fabric, and aerospace composites. Germany is a powerhouse in high-tech weaving machines and dyeing chemicals. They don’t make millions of T-shirts, but they make the tools that let others do it.

Why China still wins the title of largest supplier

Let’s be clear: when we say "largest supplier," we mean total output. China doesn’t just export - it consumes. It makes textiles for its own massive domestic market, which has over 1.4 billion people. That internal demand means Chinese factories run at near-full capacity year-round. In 2025, China produced 85 million metric tons of textile fiber - more than the entire output of Europe, North America, and Africa combined.

China also controls the supply of key raw materials. It’s the world’s largest producer of synthetic fibers like polyester and nylon, which now make up over 70% of all textiles. It mines the oil, refines the chemicals, and spins the fibers - all domestically. No other country has that level of vertical control.

And when it comes to speed, China’s logistics are unmatched. A factory in Guangdong can ship a container of fabric to Los Angeles in 14 days. A similar order from India might take 28 days. For fast-fashion brands that need new styles every week, that 14-day window is everything.

What’s changing in the global textile market

The textile world is shifting. Rising labor costs in China are pushing some production to Southeast Asia. Environmental regulations are forcing factories to upgrade. And consumers are asking tougher questions: Where was this made? Is it ethical? Is it sustainable?

India is betting big on sustainability. It’s the world’s largest producer of organic cotton, and its government is subsidizing solar-powered mills. Many Indian exporters now offer carbon-neutral shipping and traceable supply chains - something China still lags behind in.

Meanwhile, China is doubling down on automation. Factories are installing AI-powered looms that reduce waste by 30%. They’re using robotics to handle fabric cutting and packaging. In 2025, one Jiangsu-based mill cut its workforce by 60% but increased output by 25%.

The future won’t be about who makes the most - it’ll be about who makes it smarter, faster, and cleaner.

Who should you source from?

If you’re a business looking to source textiles, here’s the reality:

- For volume, low cost, and speed - go to China.

- For cotton goods, ethical production, and small orders - go to India.

- For fast fashion and apparel - consider Vietnam or Bangladesh.

- For home textiles in Europe - Turkey is your best bet.

- For technical fabrics or high-tech materials - look to the U.S. or Germany.

There’s no single "best" supplier. The right choice depends on what you need, how much you need, and what values you stand for.

Is India the largest textile manufacturer in the world?

No, India is the second-largest textile producer, behind China. While India leads in cotton production and exports, China produces more total textiles - including synthetic fibers, garments, and home textiles - than any other country. India’s strength lies in its handloom traditions, organic cotton, and ability to handle small custom orders.

Why does China dominate textile production?

China dominates because it controls every step of the process: from oil refining for synthetic fibers to spinning, weaving, dyeing, and garment assembly. It has over 12,000 textile mills, massive infrastructure investments, and highly efficient logistics. It also produces and consumes more textile fiber than any other country, giving it unmatched scale and speed.

Does India export more textiles than China?

No, China exports more total textiles than India. In 2025, China exported $185 billion in textiles and apparel, while India exported $42 billion. However, India is the world’s largest exporter of cotton textiles, including fabrics, bed linens, and cotton garments. China leads in synthetic fibers and mass-produced apparel.

What is the biggest textile export from India?

India’s biggest textile export is cotton fabric, followed closely by cotton garments and home textiles like bed sheets and towels. In 2025, cotton fabrics made up nearly 45% of India’s total textile exports. Its handwoven silk and embroidered linens are also in high demand in Europe and North America.

Can India overtake China as the top textile supplier?

It’s unlikely in the short term. China’s scale, automation, and control over synthetic fiber production are too deeply entrenched. But India could become the top supplier for sustainable, ethical, and cotton-based textiles. If India continues investing in green mills and traceable supply chains, it may dominate the premium market segment - even if it doesn’t surpass China in total volume.