Why Toyota Stopped Operations in India - Key Reasons Behind the Exit

Why Toyota Stopped Operations in India - Interactive Analysis

This interactive tool analyzes the key reasons behind Toyota's exit from India. Explore how various factors contributed to their decision.

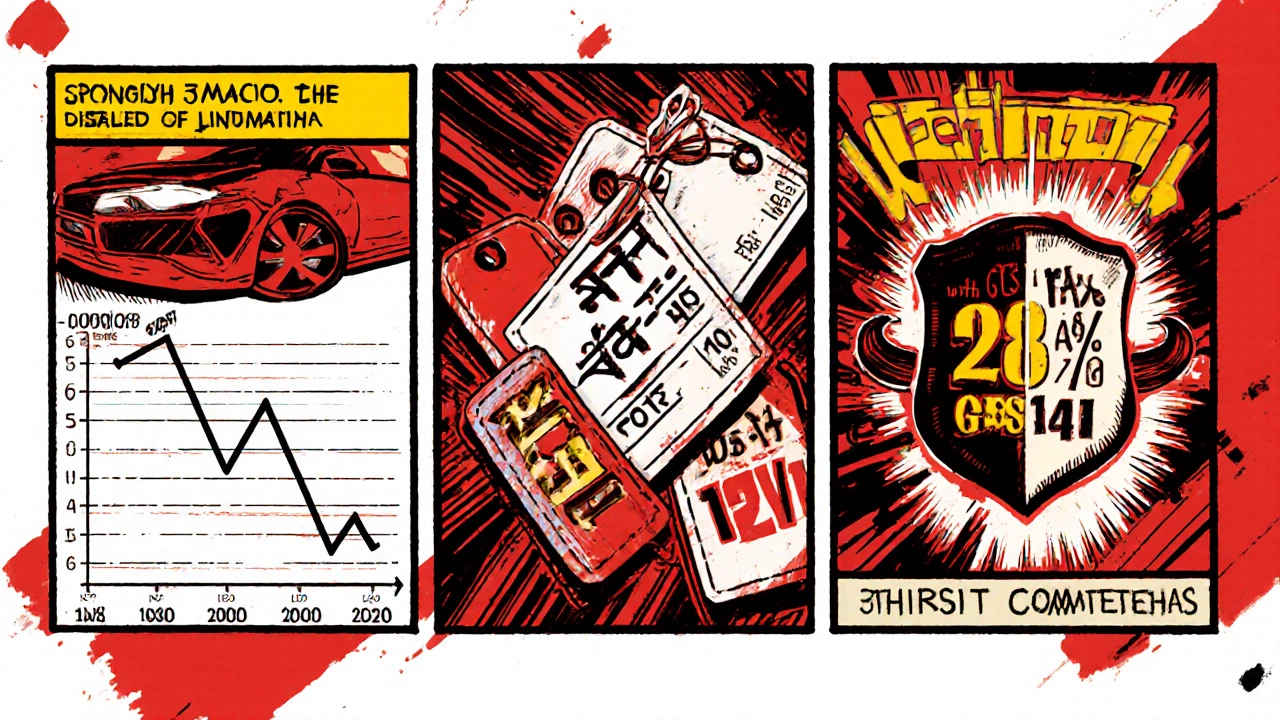

Sales Decline

Toyota's sales dropped significantly after 2017, falling below 100,000 units by 2022 due to increased competition and changing consumer preferences.

High ImpactRegulatory Pressures

High taxes, GST rates, and strict emission norms increased operational costs and reduced competitiveness.

High ImpactCost Pressures

Low plant utilization, rising material costs, and currency fluctuations eroded profit margins.

Medium ImpactStrategic Shift

Focus on EV development globally led to reallocation of resources away from low-growth markets.

Medium ImpactInteractive Scenario Builder

Adjust the sliders below to simulate how different factors might affect Toyota's decision:

Decision Outcome

Key Takeaways

- Toyota halted Indian production mainly because sales fell sharply and profit margins thinned.

- High import duties, tax structures and stringent emission norms added cost pressure.

- The global shift toward electric vehicles forced Toyota to re‑allocate resources away from low‑margin ICE plants.

- A strategic partnership with Suzuki reshaped Toyota’s market approach, reducing the need for its own factories.

- The shutdown impacts thousands of jobs but opens space for other OEMs to expand.

When Toyota a Japanese automotive giant known for reliability and hybrid technology decided to pull the plug on its Indian manufacturing operations, industry watchers asked, “why?”. The answer isn’t a single headline-it’s a blend of falling demand, policy headwinds, cost squeezes, and a reshaped global strategy. Below we break down each factor so you can see the full picture behind the Toyota stop in India and what it means for the country’s auto sector.

Background: Toyota’s Journey in India

Toyota entered the Indian market in 1997 through a joint venture with the Kirloskar Group, forming Toyota Kirloskar Motor the local manufacturing arm responsible for producing models like the Innova and Etios. Two plants were built-Bidadi near Bangalore (producing the Corolla and later the Camry) and a second facility in Gujarat for the Etios and Yaris. For almost three decades, the brand built a reputation for durability, especially with fleet buyers and corporate customers.

Sales peaked around 2015‑2016, hitting roughly 170,000 units per year. However, after 2017 the numbers started a steady decline, dipping below 100,000 units by 2022. The slowdown coincided with a broader market slowdown, rising competition, and shifting consumer preferences toward compact, cheaper cars.

Market Challenges: Demand Slump and Competitive Pressure

The Indian passenger‑vehicle market contracted by 6% in FY2022‑23, according to the Society of Indian Automobile Manufacturers (SIAM). Toyota’s segment-mid‑size sedans and MPVs-felt the brunt because price‑sensitive buyers favored smaller hatchbacks from Maruti Suzuki and Hyundai. While Toyota’s average selling price (ASP) stayed around ₹12‑13 lakh, its rivals were offering comparable space for under ₹8 lakh.

Moreover, the rise of affordable C‑segment SUVs (e.g., Kia Seltos, Tata Nexon) pulled potential customers away from traditional sedans. Toyota’s flagship models, though praised for quality, struggled to justify their premium price in a market where fuel efficiency and upfront cost dominate buying decisions.

Policy & Regulatory Headwinds

India’s tax regime added another layer of difficulty. The Goods and Services Tax (GST) on automobiles sits at 28%, and on top of that, a 12% cess on cars with engines over 1.2L pushes the total cost even higher. Imported components-especially for hybrid powertrains-face a 10% basic customs duty plus a 7% safeguard duty that was re‑imposed in 2023 to protect domestic manufacturers.

Emission norms also tightened sharply. The transition from BS‑VI to BS‑VII standards (effective 2025) requires costly upgrades to engine control units and after‑treatment systems. For a plant already operating below capacity, the return on such capital investment looked unattractive.

Finally, the Indian government’s aggressive push for electric mobility-aiming for 30% EV sales by 2030-means manufacturers must invest heavily in new tooling, battery‑compatible platforms, and charging‑infrastructure partnerships. Toyota’s hybrid‑centric lineup, while environmentally friendlier than pure ICE, does not meet the future EV quota, prompting a strategic rethink.

Cost Pressures and Plant Utilization

By 2023, Toyota’s Bidadi plant was running at roughly 55% capacity, and the Gujarat facility even lower. Under‑utilization spikes per‑unit production costs: labor, energy, and depreciation expenses spread over fewer vehicles. Coupled with a volatile rupee-averaging a 4% depreciation against the yen each year since 2020-export‑oriented components became less competitive.

Additionally, the company faced rising raw‑material prices, especially steel (up 22% YoY in 2023) and semiconductor shortages that forced production delays across the global auto industry. These cost escalators eroded profit margins that were already thin on the Indian market.

Global Strategic Shift: EV Focus and the Suzuki Alliance

In 2022, Toyota announced a worldwide investment of $70billion into electrification, hydrogen fuel cells, and autonomous driving. The bulk of these funds is earmarked for markets where EV adoption is accelerating faster than in India. As a result, the company began reallocating capital away from low‑margin, low‑growth plants.

Concurrently, Toyota deepened its partnership with Suzuki Motor Corp the Japanese automaker that dominates the entry‑level segment in India through Maruti Suzuki. The alliance grants Toyota access to Suzuki’s extensive dealer network and cost‑effective platforms, reducing the need for its own costly assembly lines. Through the partnership, Toyota can market hybrid or EV variants built on Suzuki’s chassis, sidestepping the high fixed‑cost structure of its own plants.

This strategic pivot mirrors what Toyota did in other emerging markets-favoring joint‑venture or licensing models over wholly owned factories when the economics don’t stack up.

Impact of the Shutdown

The immediate fallout includes the loss of approximately 2,400 direct jobs at the Bidadi plant and 800 at Gujarat, plus indirect employment for thousands of suppliers and logistics providers. The Indian government announced a short‑term skill‑upskilling package, but the broader supply chain faces a restructuring period.

On the consumer side, the exit reduces domestic competition in the premium sedan segment, potentially leading to higher prices for the remaining players (e.g., Honda, Hyundai). However, it also frees up production capacity that could be repurposed for EV assembly if the government offers incentives.

What’s Next for the Indian Auto Landscape?

Even with Toyota’s retreat, the Indian market remains a magnet for global OEMs. Companies like Kia, MG, and even Tesla are pouring resources into local manufacturing or assembly. The vacuum left by Toyota could accelerate the entry of new EV players, especially those with flexible modular platforms.

Policy makers are also tweaking incentives-offers of up to 30% tax rebate on EVs priced below ₹15 lakh, and a push for domestic battery gigafactories. If these measures stick, the profitability equation for future automakers could look very different from the one that strained Toyota’s plants.

Checklist: Factors Behind Toyota’s Exit

| Factor | What Happened | Impact on Toyota |

|---|---|---|

| Sales Volume | Decline from ~170k (2016) to <100k units (2022) | Revenue shortfall and lower plant utilization |

| Pricing Pressure | Competitors offering similar space at 30‑40% lower price | Eroded profit margins |

| Tax & Duties | 28% GST + 12% cess + 10% customs on key components | Higher effective cost per vehicle |

| Regulatory Changes | BS‑VII emission standards, upcoming EV quota | Capital required for compliance not justified |

| Strategic Shift | Global $70B EV investment, Suzuki partnership | Redirected focus away from low‑margin ICE plants |

Frequently Asked Questions

Did Toyota completely exit India?

Toyota halted local manufacturing but continues to sell imported models and plans to bring hybrid and EV variants through its partnership with Suzuki.

How many jobs were affected by the plant closures?

Roughly 3,200 direct employees lost jobs, while thousands of supplier and logistics workers face reduced demand.

What role does the Suzuki partnership play?

The alliance lets Toyota use Suzuki’s cost‑efficient platforms and dealer network, enabling it to offer models in India without bearing the full cost of its own factories.

Will new electric‑vehicle plants replace the old Toyota factories?

The government is encouraging EV‑focused investments, and several OEMs have expressed interest in using existing industrial zones, but no firm plan has been announced yet for the specific Toyota sites.

How does the exit affect Indian consumers?

Customers lose a locally produced premium option, which may lead to higher prices for remaining brands. However, the space opens for new EV models that could offer fresh choices with lower operating costs.