What Is India’s Global Rank in Electronics Manufacturing?

India Electronics Manufacturing Growth Calculator

Input Your Assumptions

Projected Manufacturing Value

Enter values above to see projections

Key Insights:

To reach the target of $300B by 2030, India needs an average annual growth rate of approximately 14%.

Based on 2024 production of $110B, a 10% growth rate would produce $195B by 2030.

India isn’t just a market for electronics-it’s becoming a major maker of them. While people often think of China or Vietnam when it comes to global electronics production, India has quietly climbed the ladder. By 2025, India ranks 5th in the world for electronics manufacturing output, behind China, Vietnam, South Korea, and Malaysia. That’s up from 12th place just five years ago.

How India Got to 5th Place

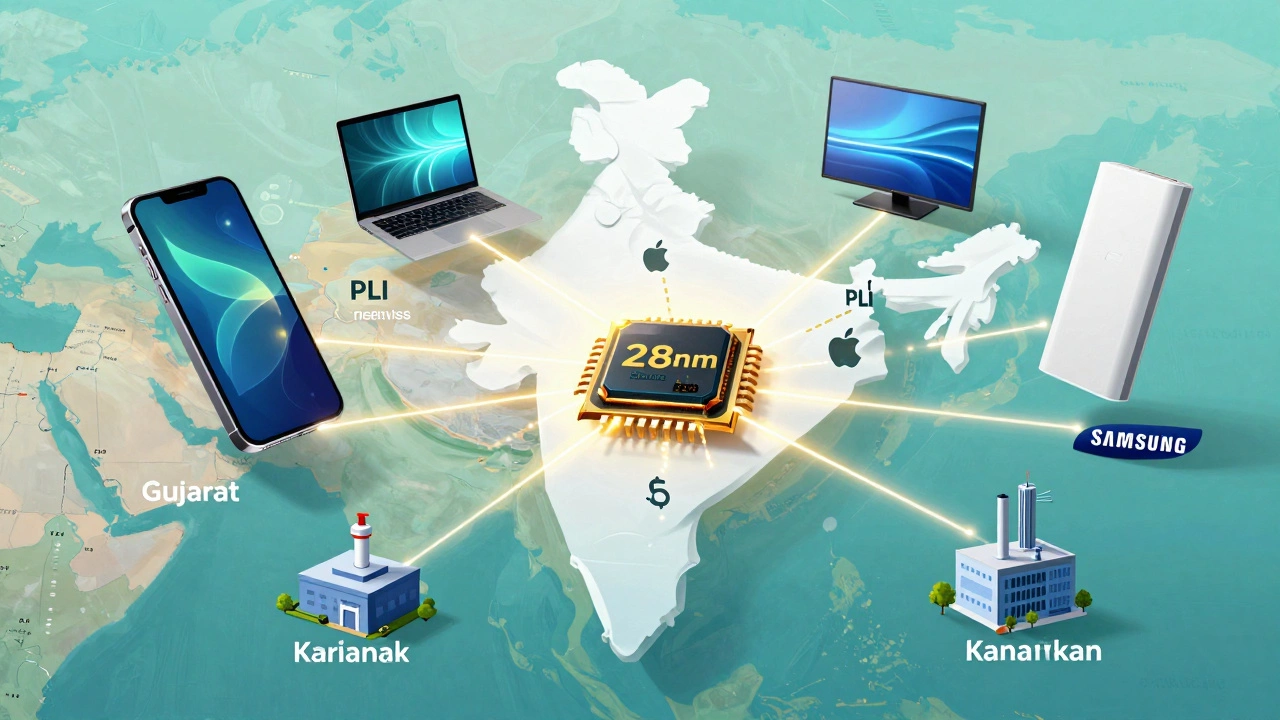

The jump didn’t happen by accident. Starting in 2019, the Indian government launched the Production Linked Incentive (PLI) scheme, offering cash rewards to companies that increased manufacturing here. Big names like Apple, Samsung, and Foxconn took notice. Samsung now makes over 70% of its global smartphones in India. Apple’s iPhone 15 series is partly assembled in Tamil Nadu and Karnataka. These aren’t just assembly lines-they’re full-scale factories with local suppliers, testing labs, and R&D teams.

By 2024, India produced over $110 billion worth of electronics. That’s more than the entire GDP of countries like Sri Lanka or Bangladesh. Mobile phones make up 60% of that total, but other categories are growing fast: laptops, wearables, TVs, and even circuit boards are now being made locally. In 2023, India exported $48 billion in electronics-up 35% from the year before.

What’s Being Made in India

Most people know India makes smartphones. But here’s what else is now being built locally:

- Over 90% of smartphones sold in India are made here

- More than 40% of tablets and smartwatches sold in India are locally manufactured

- India now produces over 15 million laptops annually, mostly for domestic use and export to Africa and the Middle East

- TV manufacturers like LG and Sony have shifted 60% of their India-bound units to local plants

- India is starting to make power banks, chargers, and even semiconductor packaging-components once imported entirely

Even more surprising: India is now the second-largest producer of printed circuit boards (PCBs) in Asia, after China. Companies like Dixon Technologies and Syska LED are building PCB factories in Andhra Pradesh and Telangana. These aren’t simple assemblies-they’re high-density boards used in medical devices and automotive systems.

Why Other Countries Are Watching

China still dominates global electronics production, making over 30% of the world’s devices. But rising labor costs, trade tensions, and supply chain risks have pushed global brands to look elsewhere. India offers something China no longer does: stable policy, growing domestic demand, and a young workforce willing to learn new skills.

Vietnam is India’s closest competitor. It made $85 billion in electronics in 2024, while India hit $110 billion. But Vietnam’s population is smaller, and its skilled labor pool is shrinking. India added 12 million new manufacturing jobs between 2020 and 2025-most of them in electronics. The country now has over 500 electronics manufacturing units with over 500 employees each.

South Korea and Malaysia still lead in high-tech areas like memory chips and advanced semiconductors. But India is catching up fast. In 2024, the first Indian-made 28nm microchips rolled off a production line in Gujarat. That’s not cutting-edge yet-but it’s a start. The government has committed $10 billion to build semiconductor fabs by 2030.

Challenges Still Facing India

Ranking 5th sounds impressive, but there are cracks in the foundation. India still imports over 70% of its electronic components-from chips to capacitors to display panels. Most of these come from China, Taiwan, and South Korea. Without local supply chains, the country remains vulnerable to global disruptions.

Power supply is another issue. Many factories in Uttar Pradesh and Maharashtra still face 3-4 hours of daily outages. While solar and battery backups are being installed, reliability remains inconsistent compared to Vietnam or Thailand.

And then there’s the skills gap. India graduates 1.5 million engineers every year, but only 20% of them are ready to work in electronics manufacturing. Training centers run by companies like Intel and Qualcomm are helping, but progress is slow.

What’s Next for India?

The goal isn’t just to rank higher-it’s to become a global hub for end-to-end electronics production. By 2030, India aims to produce $300 billion worth of electronics annually. That would put it in the top 3 globally.

Three things will make that happen:

- Building local component supply chains-especially for semiconductors, batteries, and sensors

- Expanding PLI to cover more product categories like medical electronics and automotive sensors

- Partnering with global players like TSMC and Micron to set up chip fabs in India

Already, Micron has announced a $2.75 billion memory chip assembly plant in Gujarat. TSMC is in talks to build a test and pack facility in Tamil Nadu. If those happen, India won’t just be assembling devices-it’ll be making the brains inside them.

Why This Matters for the World

When India scales up electronics manufacturing, it doesn’t just change its own economy-it reshapes global supply chains. Brands that once relied on China for 80% of their production now have a reliable backup. Retailers in Europe and the U.S. are shifting orders to India to reduce shipping times and avoid tariffs.

For developing countries in Africa and Southeast Asia, India is becoming a new source of affordable electronics. Indian-made smartphones now sell in Nigeria, Kenya, and Bangladesh at prices 30% lower than Chinese models. That’s not just commerce-it’s tech access.

India’s rise in electronics manufacturing isn’t about replacing China. It’s about making the global system more resilient. And right now, no other country is moving as fast.

What is India’s current rank in global electronics manufacturing?

As of 2025, India ranks 5th in the world for electronics manufacturing output, behind China, Vietnam, South Korea, and Malaysia. This is a major jump from 12th place in 2020, driven by government incentives, foreign investment, and growing domestic demand.

How much electronics does India produce annually?

In 2024, India produced over $110 billion worth of electronics. This includes smartphones, laptops, TVs, wearables, and circuit boards. Mobile phones account for about 60% of this total, with exports reaching $48 billion that year.

Which companies manufacture electronics in India?

Major global brands like Apple, Samsung, Foxconn, Xiaomi, and Oppo now have large-scale manufacturing facilities in India. Local companies like Dixon Technologies, Syska LED, and Micromax also produce smartphones, TVs, and power banks. Intel, Micron, and TSMC are setting up advanced semiconductor assembly and testing units.

Does India make its own chips?

India doesn’t yet produce cutting-edge semiconductor chips like 5nm or 3nm processors. But in 2024, the country began manufacturing 28nm microchips locally for use in automotive and industrial devices. Plans are underway to build full-scale fabs by 2030 with investments from global players like TSMC and Micron.

What are India’s biggest challenges in electronics manufacturing?

India still imports over 70% of its electronic components, mainly from China and Taiwan. Power reliability, skilled labor shortages, and weak local supply chains for parts like capacitors and sensors remain major hurdles. While progress is fast, building self-reliance in critical components will take another 5-7 years.

What This Means for You

If you’re a consumer, India’s growth means more affordable, locally supported electronics. If you’re a business, it’s a chance to tap into a new manufacturing base with lower costs and faster delivery. If you’re an investor, the PLI scheme and rising exports signal long-term potential.

India’s electronics story isn’t about being the biggest. It’s about being the most reliable alternative. And right now, that’s worth more than any ranking.